Let’s get down to brass tacks: for all of the opportunities presented by modern, cloud-native data stacks, the mainframe remains the backbone of most financial services enterprises.

It holds onto this central position because industry leaders trust their mainframes to securely house decades of valuable account data, transaction histories, and operational records. All of which is instrumental in maintaining compliance, unlocking customer insights, and ratcheting up operational efficiency.

The problem? Too much of this valuable data is stuck in COBOL-based systems and batch jobs, locked away like a fortune in a vault that nobody has the key to.

Meanwhile, the world outside of financial institutions is moving faster everyday. Customers expect personalized experiences. Regulators demand timely reporting. Competitors are leaning into AI and analytics.

The stakes couldn’t be higher, but the mainframe, powerful and secure as it may, wasn’t built for this kind of agility. Without modernization, mainframe data risks being locked away for good. Maintenance costs are only going to go up, and the demand to be more nimble is only going to grow more urgent.

IBM Consulting’s Modernization Mandate

IBM Consulting is uniquely positioned to help financial institutions bridge the gap between mainframe and cloud architectures.

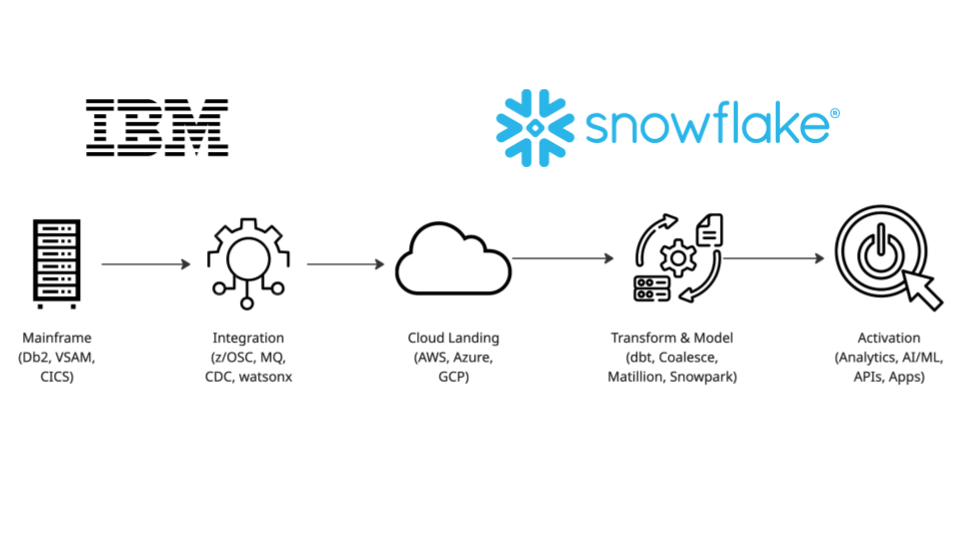

With deep zSystems heritage, IBM intimately understands the technology stacks that underpin banking operations and the regulatory pressures that shape them. At the same time, IBM brings a powerful ecosystem of tools—z/OS Connect, data virtualization, watsonx—that make it possible to integrate mainframe data with cloud platforms.

Outside of its in-house toolkit, IBM also benefits from its partnership with Snowflake and every major hyperscaler, which allows the firm to ensure financial services clients get the best-fitting architecture for their specific needs.

That last part is the key here, because the goal is not just modernization for its own sake. The goal is modernization with measurable outcomes: agility, compliance, cost optimization, and accelerated innovation.

Modernization Isn’t Just Migration

Too often, modernization is treated as synonymous with “moving everything to the cloud.” For financial services, that easy conflation is neither practical nor desirable.

Modernization doesn’t mean pulling the plug on your mainframe. It means putting its data to work. Transaction-heavy workloads that demand reliability and security still belong on the mainframe in most cases, but the real opportunity lies in activating that data for everything else.

With a hybrid approach to the modern data stack, financial institutions can keep mission-critical processing where it performs best, while shifting advanced analytics, AI/ML, and customer-facing innovation to the cloud. Streaming mainframe data into Snowflake makes insights available almost instantly, turning yesterday’s batch reports into today’s hair-trigger decision making.

Selective offloading further reduces costs, moving the right workloads to cloud platforms to ease MIPS consumption. The result is greater decision-making agility, more efficient operations, and a pathway to innovation that doesn’t require abandoning trusted systems.

Snowflake’s Home Game Advantage in the Hybrid Age

At its core, the Snowflake AI Data Cloud isn’t in the market as a mainframe replacement. Given the right hybrid architecture, Snowflake is actually a force multiplier for that treasure vault of mainframe data.

When combined with IBM Consulting’s integration capabilities (and with Hakkoda’s industry-first expertise in Snowflake deployment), Snowflake provides financial institutions the ability to:

- Unify data across structured, semi-structured, and unstructured sources in one secure platform.

- Aggregate data for compliance reporting with regulators and partners through secure data sharing.

- Run advanced AI/ML models natively using Snowpark, Cortex, and the platform’s thriving partner ecosystem.

- Scale elastically to handle compute-intensive analytics without driving up mainframe costs.

Real-World Use Cases in Financial Services

This emerging hybrid approach to the modern data stack is already proving itself across the financial services industry, with promising use cases that include:

- Regulatory Reporting: Accelerating FFIEC, BCBS 239, and liquidity reporting through cloud-based data aggregation.

- Risk & Fraud Analytics: Detecting anomalies in real time by blending historical and streaming data.

- Customer 360 & Personalization: Integrating decades of customer interactions to deliver tailored, modern experiences.

- Market & Trading Insights: Leveraging historical market data for predictive models that give institutions a competitive edge.

By bringing trusted mainframe data into a single, cloud-native source of truth, institutions grow in their ability to meet regulatory demands, protect against risk, and deliver new customer experiences without compromising the security and reliability that are the mainframe’s best attributes.

The Future of Financial Services Modernization Demands Hybrid Solutions

The future of financial services isn’t about choosing between the secure power of mainframe systems and the agile, AI-ready capabilities of the cloud. Industry leaders instead need to walk a middle path in which mainframe systems and cloud platforms come together in symbiosis.

To that end, IBM Consulting’s unmatched expertise in mainframe systems serves as a trusted on-ramp for modernization initiatives. Decades of experience with zSystems, regulatory demands, and mission-critical operations ensure that core transactional workloads remain secure, reliable, and compliant as institutions dip their toes into new cloud-enabled capabilities.

Snowflake, in turn, complements this foundation by serving as the place where innovation happens. Rather than replacing the mainframe, it amplifies its value by providing the scale, flexibility, and AI-ready environment needed for advanced analytics, machine learning, and customer-facing applications.

IBM’s vendor-agnostic modernization approach starts with what clients need most: agility, compliance, and measurable value. That focus on outcomes is precisely why Snowflake so often becomes the natural partner in the journey.

By combining IBM’s deep systems expertise with Snowflake’s innovation engine, financial institutions can unlock those winning outcomes for themselves. And with Hakkoda, now an IBM company, you get a team that understands both worlds.

Ready to lead your industry into a hybrid future? Let’s talk.