For leading financial institutions, driving alpha is the name of the game. But measuring and optimizing investment strategies against the market effectively can be a herculean feat for firms still leaning on legacy tech.

End-to-End Investment Analytics

For leading financial institutions, driving alpha is the name of the game. But measuring and optimizing investment strategies against the market effectively can be a herculean feat for firms still leaning on legacy tech.

Hakkoda’s Modern Asset Management & Business Analytics Accelerator (MAMBA) is an end-to-end investment analytics solution.

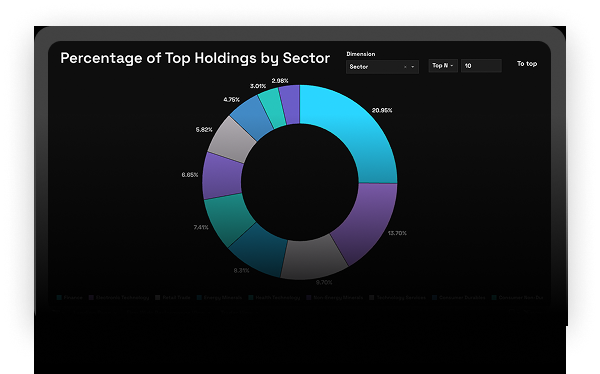

A More Efficient Way to Access, Analyze, and Share Financial Data

A Single Source of Truth for Asset Management and Analytics

MAMBA centralizes data, integrates advanced analytics, and ensures top-tier security and scalability, empowering teams to focus on analysis while enriching datasets. For portfolio and risk managers, MAMBA offers real-time trade and asset allocation insights, while leveraging Snowflake’s marketplace and ecosystem for seamless data augmentation and compliance management.

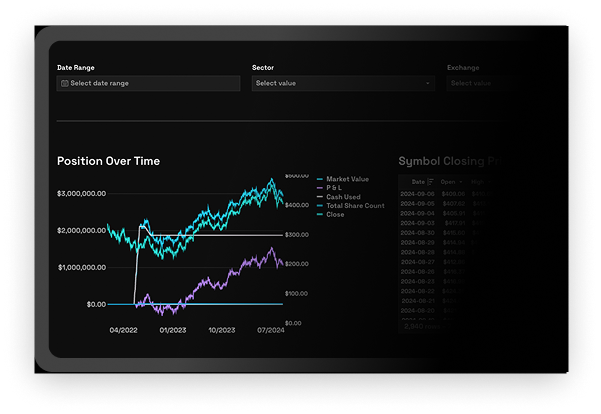

Advanced Time Series Analytics

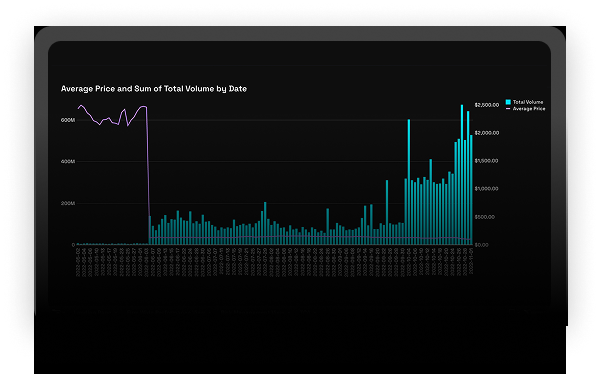

MAMBA’s Transaction Cost Analysis (TCA) feature is designed to elevate trading strategies by providing stakeholders with an in-depth look at trade execution quality, market liquidity, and trading costs. Utilizing Tick History data readily available from multiple sources in Snowflake Marketplace, MAMBA’s end-to-end analytics platform powers real-time analytics drawing on everything from price movement insights, to volume analytics, to volatility insights, to benchmarking, market impact predictions—all from within your Snowflake environment.

Advanced Research Analytics

Leveraging Snowflake’s Cortex AI, MAMBA’s Research Live feature automates data gathering, providing analysts with real-time access to crucial financial information. Through natural language interactions with Cortex Assistant, analysts are equipped to quickly analyze breaking news, earnings releases, and economic announcements to make timely, informed decisions supported by real-time forecasting and anomaly detection capabilities.