The financial services industry is changing quickly, and data is at the heart of this rapid transformation. Whether it’s managing stock data, tracking ETF performance, monitoring the crypto market, or navigating forex trading, data’s role is indispensable to staying on top of volatile markets and developing future-proofed business strategies.

In this article, we’ll explore how the combination of Snowflake and Coalesce empowers financial services companies to make data-driven decisions faster and more efficiently. We’ll also illustrate this empowerment by highlighting a specific use case to analyze market trends over the last 10 years.

The Data-Driven Imperative in Financial Services

The financial services sector has been quick to embrace the power of data, but the vast volumes of information available to many of these organizations can be both a valuable asset and a significant challenge. When leveraged well, data can be a goldmine of insights that lead to impactful business decisions, but financial institutions often face infrastructure barriers when it comes to accessing and utilizing this data effectively.

These data infrastructure challenges can slow down the adaptation and evolution of data strategies in financial services, but the case for data-driven innovation in the financial industry only continues to grow stronger. This tension points to the importance of an organization-wide data strategy that embraces the benefits of the modern data stack inside a data architecture that brings efficiency, accuracy, and security to the business.

For most organizations, the principle challenge of harnessing the power of data lies in understanding where to begin. Organizing and implementing multiple data workstreams, including analytics, intelligence, and decision-making, can be complex. Additionally, exciting new technologies like artificial intelligence and machine learning, though promising, can be challenging to implement without the fundamentals of a modern data strategy already in place. In a highly regulated industry like financial services, getting data management wrong can have severe consequences, which makes it that much more crucial to have a clear data innovation roadmap in place.

How Snowflake and Coalesce Enhance Data Transformation

In recent years, cloud adoption has driven significant advancements in the financial services industry. Cloud platforms and cloud providers have improved financial institutions’ decision-making through enhancements to their infrastructure, flexibility, scalability, and automation.

The Snowflake Data Cloud provides solutions in “data storage, processing, and analytic solutions that are faster, easier to use, and far more flexible than traditional offerings,” and that can be hosted on any cloud platform (Snowflake Documentation). Snowflake’s Financial Services Data Cloud also offers tailored solutions that are unique to financial services companies, along with robust support for the development of monetizable Native Applications, both of which strengthen its case as the cloud data solution of choice for organizations wondering where to start their data innovation journey.

Coalesce, meanwhile, is a data transformation and orchestration solution, uniquely built for Snowflake, that streamlines data ingestion, transformation, and automation. It ensures efficient data workflows, optimized query performance, and robust data governance, essential in financial services with stringent regulatory requirements. Coalesce simplifies the management of data transformation pipelines, allowing financial analysts to work with data without extensive coding.

A Data Transformation Capstone with Snowflake & Coalesce

To get a better sense of just how streamlined data transformation on Snowflake can be, a small team at Hakkoda composed of Sebastian Miranda, Andrew Visich, and myself recently built a “capstone project.” The scope of this project was to answer, “What financial instrument would have proved the better investment over the last 10 years?”

To answer this question, we sourced 10 years of relevant data from an API, built a simple modern data stack architecture, and then used a modern data stack ELT (consisting of Snowflake and Coalesce) to transform and analyze the data. I answered and visualized a couple of straightforward business questions to help guide the overall story in a dashboard, hosted on Snowflake.

I’ve provided some screenshots of the high-level outputs from that dashboard below, and would be happy to share a video walkthrough with interested parties in the future.

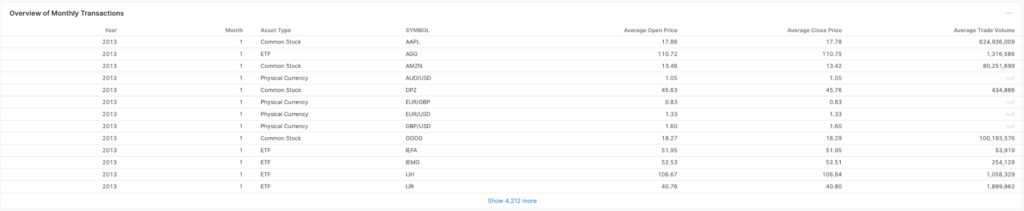

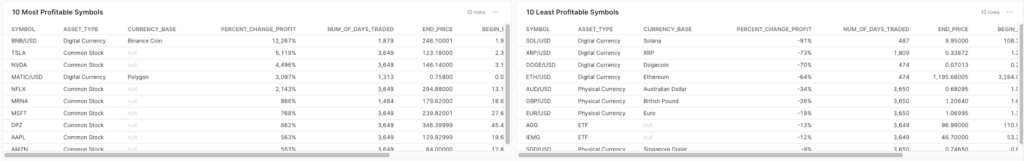

A 30,000 ft overview of monthly transactions per year. This is a view of all our data (e.g., stocks, crypto, etf, forex, etc.) These are the 10 most + least profitable symbols in our data. Binance Coin leads the group with a whopping 12,267% gain from $1.99 on 2017-11-08 to $246.10 on 12-31-2022.

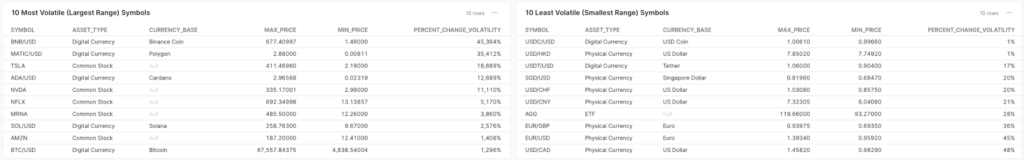

These are the symbols ranked by volatility between Max Price and Min Price (aka which symbol had the highest high and the lowest low). The winner again is Binance Coin with a low of $1.49 and a high of $677.41.

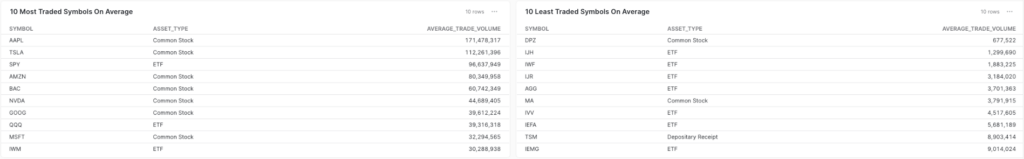

Another important metric when looking at trading financial instruments is the volume that’s traded. Here, we are ranking the symbols by their average daily trade volume. Apple Inc. (AAPL) was traded the most while Domino’s Pizza (DPZ) was traded the least.

To reiterate, the example readouts above are intended as a quick introduction to the dashboard. Please feel free to reach out for an in-depth demonstration of the dashboard and a detailed walkthrough of the capstone project.

How Hakkōda Can Help You Streamline Your Data Transformation

In conclusion, Snowflake & Coalesce are powerful solutions to unlock the full potential of data in the financial services industry. Using them in a modern data stack empowers data-driven decision-making, enhances compliance, and optimizes financial strategies, ensuring that financial institutions remain well-prepared to compete in the ever-evolving world of financial services. With the right data innovation roadmap and the power of Snowflake & Coalesce, financial services companies can navigate the complexities of their data landscape, make informed decisions, and provide exceptional service to their clients.

The transition to cloud data warehousing is inevitable in the financial services industry. Hakkoda’s mission is to empower data-driven organizations, helping them embrace innovation, automation, and new opportunities. With our expertise in data warehousing and data architecture design, we can guide your financial institution in building and evolving its data strategy for success in a data-driven era.

Ready to embark on your data innovation journey? Let’s talk.